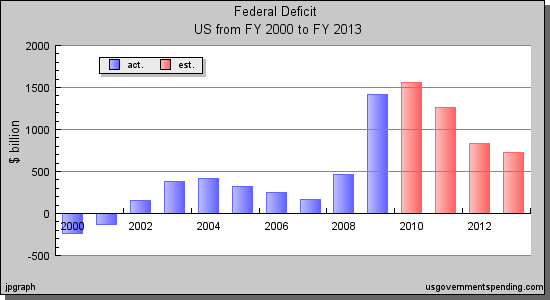

Contrary to popular myth, the rise in the deficit began before Obama's Presidency at the beginning of FY 2009 and is currently on track to be cut IN HALF to about $700 Billion by the end of his first term. This year the deficit has been reduced from over $1.5 Trillion to approximately $1.2 Trillion which is a $300 Billion Improvement.

What has made this improvement possible are what follows.

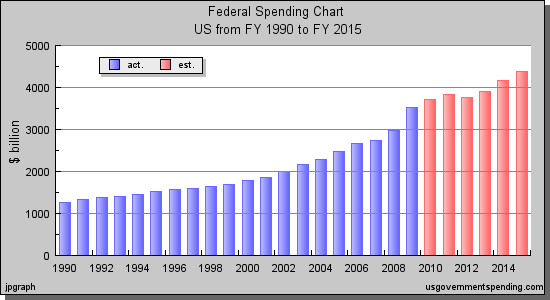

Here is the actual chart of Federal Spending since 1990.

Now despite all the claims that the Obama Administration profligate "Spending Spree" actual spending didn't really increase all that much during his tenure. In FY 2009 - which again began before he came into office - there was a jump from $3 Trillion to $3.5 Trillion. The first finger is usually pointed at TARP, yet after one counter points that that program was initiated under George W. Bush there is also the fact that the entire process wasn't simply a gift of "bailout" to Wall Street - it was a Loan.

A Loan that has been largely paid back, with interest.

The government has earned $25.2 billion on its investment of $309 billion in banks and insurance companies, an 8.2 percent return over two years, according to data compiled by Bloomberg.

Oct. 20 (Bloomberg) — Anat Admati, a professor at the Stanford Graduate School of Business, talks about bank capital requirements. Admati speaks with Deirdre Bolton and Erik Schatzker on Bloomberg Television’s “InsideTrack.”

The U.S. government’s bailout of financial firms through the Troubled Asset Relief Program provided taxpayers with higher returns than yields paid on 30- year Treasury bonds — enough money to fund the Securities and Exchange Commission for the next two decades.

Other "Bailouts" such as those with Detroit Auto Manufacturers were also essentially loans and with the new IPO from GM, the government actually made money on the deal while saving Millions of Jobs.

Seventeen months after its old shares were made worthless in bankruptcy court, General Motors Co. made a dramatic return to the stock market following a government-led turnaround that proved far more successful than many had expected.

GM shares rose in their first day of trading but are they a good long-term investment? David Weidner explains to Simon Constbale his view on the subject.

In their first day of trading Thursday, GM shares opened at $35, two dollars above the price investors paid for them in the company's initial public offering Wednesday. In trading, they climbed to as high as $35.99 before closing at $34.19.

People have argued that the Recovery Act accounts for massive "Run Away Spending" except that they ignore that 40% of that bill included Tax Cuts for of $400 per person and $800 per family per year affecting 95% of the public.

The stimulus, formally known as the American Recovery and Reinvestment Act, included tax cuts for many Americans, Obama said.

"We cut taxes. We cut taxes for 95 percent of working families. We cut taxes for small businesses," Obama said. "We cut taxes for first-time homebuyers. We cut taxes for parents trying to care for their children. We cut taxes for 8 million Americans paying for college."

Democrats applauded, while Republicans were silent for the most part. In one of the unscripted moments of the night, Obama looked at the Republican side of the room, smiled and said, "I thought I'd get some applause on that one."

Here, we wanted to check Obama's statement that he cut taxes for 95 percent of working families.

The key word in his statement is "working." Obama's claim is based on a tax cut intended to offset payroll taxes. Under the stimulus bill, single workers got $400, and working couples got $800. The Internal Revenue Service issued new guidelines to reduce withholdings for income tax, so many workers saw a small increase in their checks in April 2009.

With this Bill Obama delivered on the "Middle Class Tax Cuts" that Bill Clinton had always promised, but never accomplished. Critics have claimed that the Stimulus has been a "Failure" because Unemployment went to 9% instead of the predicted 8%. That's missing the mark by 1%, by contrast what do you call invading a country for possessing, developing and sharing chemical weapons with terrorists - when they didn't have any ties to terrorist groups or any chemical weapons anymore - a bad guess? Lousy Luck? Oops?

If any single finger can be pointed to "Spending Increases" it should be directed at TARP or the Detroit Bailout, and if Obama deserves any blame for it - it's because in his first year Obama put the actual cost of the Iraq and Afghanistan War ON BUDGET.

As we have noted here before, the U.S. military has largely paid for the wars in Iraq and Afghanistan through emergency spending measures, in effect keeping wartime costs off the books. In addition to masking skyrocketing budget growth at the Department of Defense, this process has allowed the services to treat budget supplementals as a piggy bank for new procurement. Members of Congress may have grumbled about poor oversight, but they have largely acquiesced.

Obama’s message? Not anymore.

"That is why this budget looks ahead ten years and accounts for spending that was left out under the old rules – and for the first time, that includes the full cost of fighting in Iraq and Afghanistan," he said. "For seven years, we have been a nation at war. No longer will we hide its price."

So the actual "Big Spending" that Obama has done, is to just recognize and admit to spending that was already taking place.

The second argument we've heard incessantly is that "Tax Cuts don't reduce Revenue".

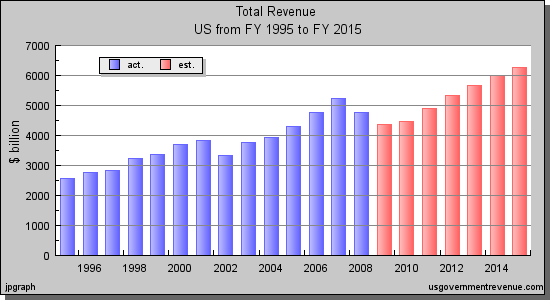

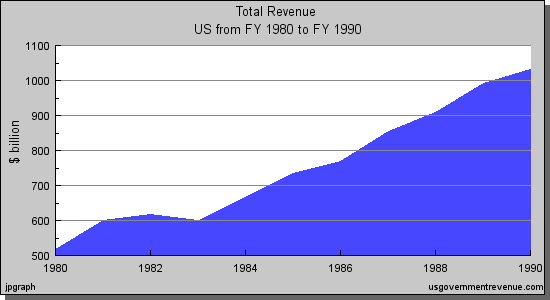

Here's a look at Federal Government Revenues also going back to 1990.

That first huge dip in revenues in 2002 are the First Bush Tax Cuts, and it's clear from this chart that it took another two years to get back to the revenues that had been coming in 2001. TAX CUTS DID NOT INCREASE TAX RECEIPTS. The second dip that can be seen is the Great Recession of 2008, which alone accounted for the largest portions (over 30%) of the deficit which Obama was saddled with when he came into office.

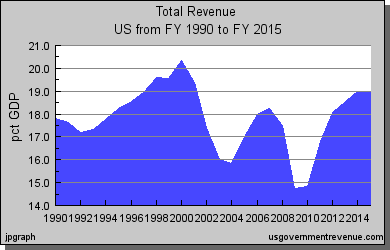

Which is also re-enforced by this chart.

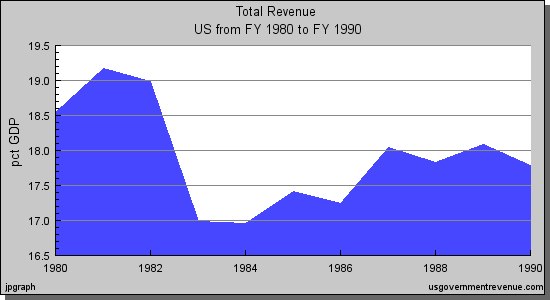

This axiom was also true during the Reagan Administration, here's what his tax cuts did to tax revenues during the 1980's.

Update Here's another version of the 80's chart without regard to GDP which grew dramatically during that time (shown on another chart below) and tends to exaggerate the amount of the revenue shortfall.

Reagan's first huge tax cut in 1981 brought to top marginal tax rate down from 70% to 40%. He then followed with several tax increases in 1983 including raising Payroll and Social Security taxes. It's clear from the chart, without regard to GDP growth, that his first tax cut for the rich (which added an estimated $264 Billion to the deficit) did not increase revenue, but his subsequent tax hikes for the working class in 83's did increase revenue.

Let's review class : Cutting Taxes for the wealthy DOES NOT increase Tax Receipts, PERIOD.

The third argument is that tax increases, such as those which are scheduled to go into effect on January 1st, unless Congress changes the law during the lame-duck session, should Never be implemented during a recession.

However, that is exactly what Bill Clinton did back in 1992 and here's what happened to the GDP.

Bill Clinton came into office in the midst of the post S&L fostered downturn in 1991, following which he raised taxes and 22 Millions Jobs did ensue until the dot com bubble burst leading to the downturn at the beginning of Bush's presidency - which never really reached the heights of economic growth that Clinton achieved. This chart clearly indicates that things didn't just suddenly crash in 2008, they were headed downward during most of Bush's Presidency. Over his entire two terms Bush only created about 1 Million Jobs, Net. During this year alone President Obama has netted over 800,000 private sector jobs, and the year isn't over yet.

Raising taxes on the wealthy is actually good for the economy because we're talking about personal income, not business income. Rich people have accountants and when their taxes go up, they seek Tax Shelters - which means they Spend Money on things that are National Priorities such as investing in their businesses, not on more Cristhal and a fresh new Beemer SUV, to go with their Rolex. (None of which btw, are produced in America!)

If Tea Party Republicans have their way and manage to extend the Bush Tax Cuts, defund or repeal Health Care Reform, which is currently targeted to save $130 Billion in spending over it's first ten years and over a $Trillion in it's second decade - the deficit situation that is currently on target to massively improve, will WORSEN.

And they'll have no one to blame but themselves. People lie, but numbers don't.

Vyan

No comments:

Post a Comment