But that's just a snare and a delusion.

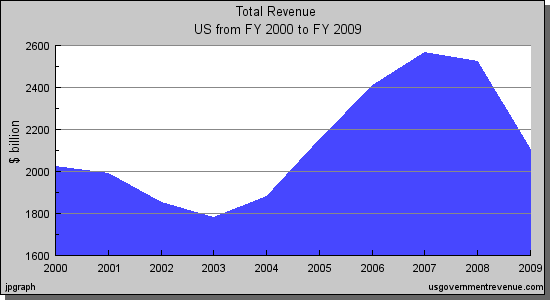

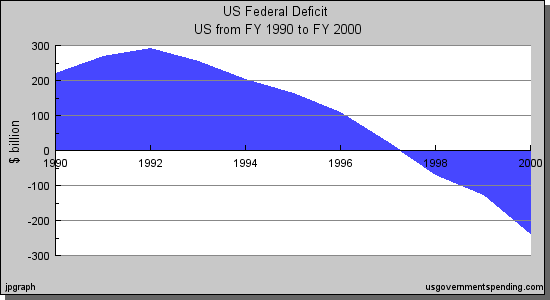

This is what the Bush Tax Cuts did to incoming Tax Revenues

Call me silly, but I think that big dip in the middle of the 2000's is an indication of lost revenues, not a gain. At the end you can see the crash 0f 08'.

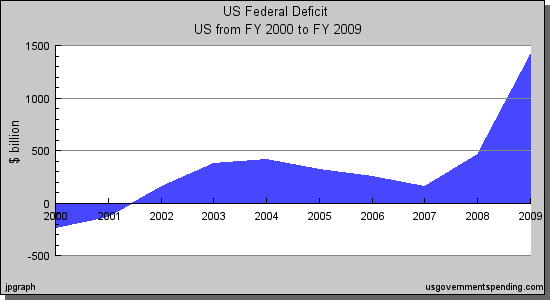

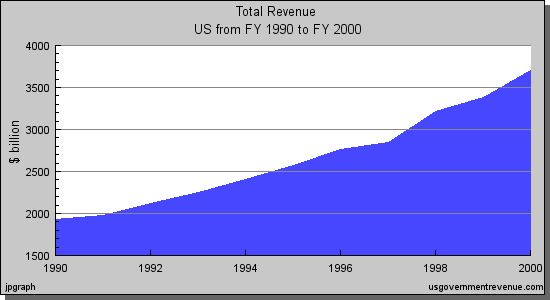

And this is what it did to the Deficit.

See how it began as a negative? That was, the now blown Clinton Surplus.

Fiscal Conservatives have been arguing their tax-cut bank-shot logic for decades. That by cutting taxes you can spur the economy, and as a result the increase economic volume will ultimately increase revenues. We can see some of this in the first chart above in that after an initial dip the revenues do begin to creep back up as they always do as more and more people join the job market - but they do so too slowly to keep up with expenditures and hence you see the deficit also grow. It's fair to point out that the deficit was shrinking up until 2008, but that's when all hell broke lose.

The problem was that economic growth that the country was depending on was based not on any real value, it was all based on Credit.

Bush's first recession took away millions of high paying tech jobs, those people eventually found new work but at much lower pay (I know, I'm one of them) - while their cost of living stayed the same or increased - consequently they turned to their savings, and when those were all gone their credit cards and mortgages to fill the gap. America's number one export in the 00's wasn't cars or silicon chips or software or even the WEB - it was DEBT. Debt that was being traded and gambled with like poker chips in Vegas, until the entire bank went broke in 2008.

Yes, you can spur the economy with tax cuts, but not ALL tax cuts have the same effect or impact. Some cuts just go into people pockets and Stay There without generating any growth at all, and that's exactly the cuts the the GOP is willing to go to the mat to support. All they want to do is FEED THE RICH.

Over and over again we've heard these voices from the Right argue that the Bush Tax Cuts for the Wealthy Don't Have to be Paid For.

David Vitter "I disagree with the Premise that Tax Cuts should be paid for..."

Pat Toomey - "It's not clear that (extended Bush Tax) would increase the deficit. We cut taxes in 2001 and by 2004 the Revenue grew, Reagan cut taxes in the 80's and by the end of the decade revenue had doubled".

Rand Paul "I don't see (the Bush Tax Cuts) as a cost to the government"

John Kyl "But you should never have to offset the cost of a deliberate decision to reduce tax rates on Americans."

Steve King "I would say you don’t have to ask for a paid-for continued (Bush) tax policy."

Toomey, Vitter, Paul, Kyl and King are wrong - the "massive debt" they're so energized by was created by Bush's Tax Policy, Spending and his subsequent CRASH. Leaving these cuts in place will continue to blow the huge whole in the deficit that began on Bush's watch, exactly the same way the deficit exploded under Reagan, and Bush Sr., until Clinton finally plugged the whole by raising the top marginal tax rate back to 39%, which is where it will go if the Bush II cuts expire.

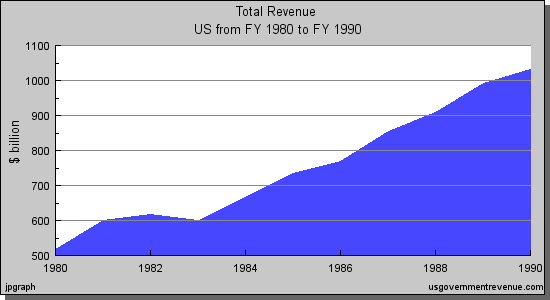

This is what Reagan did to Revenues in the 80's - look familiar?

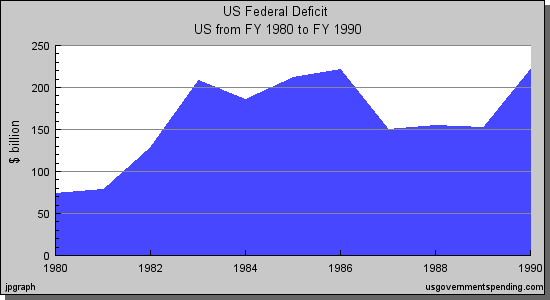

Here's his deficit numbers.

Yes, Reagan cut taxes and yes - revenue ultimately doubled from $500 Billion to $1 Trillion - but that's not all he did.

Reagan's first tax cut Bill was in 81' lowering the top marginal tax rate from 70% to 40%, and took effect in '83 - during which you can see a flatline then DIP in revenue. Later Reagan again cut the Top Marginal Rate down to 24%. Overall this reduced revenues by about $247 Billion. But then the Social Security Amendment Act of 1983, and the Deficit Reduction Act of 1984 raised taxes and generated about $50 Billion in revenues. Nowhere near enough to plug the gap created by his cuts.

Under the 1983 amendments to Social Security, signed into law by President Ronald Reagan, a previously-enacted increase in the payroll tax rate was accelerated, additional employees were added to the system, the full-benefit retirement age was slowly increased, and up to one-half of the value of the Social Security benefit was made potentially taxable income.[54][55]

...

Defecit Reduction Act

* Increased excise taxes. Increased distilled spirits excise tax and extended telephone excise tax.

* Restrictions on leasing. Reduced benefits from tax-exempt leasing and postponed effective data of liberalized finance leasing rules.

* Increased depreciable life of structures from 15 to 18 years.

* Placed state volume limitation on private purpose tax exempt bonds.

* Placed time value of money restrictions on accounting rules.

* Repealed net interest exclusion (ERTA provision) before its effective date.

* Reduced long-term capital gains holding period from one year to six months.

* Increased earned income credit rate and phaseout range.

* Set maximum estate tax rate at 55 percent.

The source of revenue increases after 1983 were these direct tax increases, not the Reagan's tax cuts - and again, those increases weren't enough to pay for his cuts.

Others have pointed the finger at Congress for not implementing Spending cuts during Reagan's Presidency, but every Budget Congress delivered Reagan spent less than what he asked for - so who was not cutting who?

Contrast Reagan and Bush Sr, with Clinton who raised the top marginal tax rate back to 39% During a Recession.

Conservatives now argue that letting the Bush Tax Cuts Expire would tank the economy and would actually Reduce Receipts, but that's not what happened under Clinton's policy - this is.

Barely a ripple, right? 22 Million Jobs were created under Clinton's Tax Policy. Bush II, after you include both of his crashes - barely created over 1 Million. Clinton also cut government spending and it's overall size by about 15% while Bush grew it larger.

It doesn't get much clearer and obvious than that. Everything these Tea-Publicans are spouting is completely backwards and upside down.

As many have noted, extending the Bush Tax Cuts for those making over $250,000 would blow a $850 Billion Hole in our Deficit. THAT. SIMPLY. CAN'T. HAPPEN.

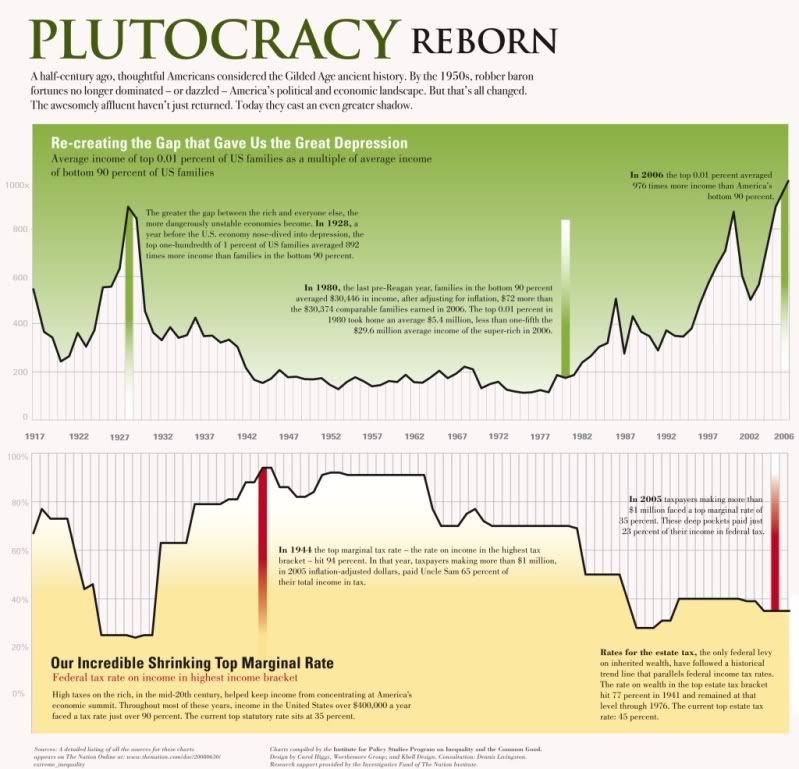

Since the Depression, greater and greater income disparity between the rich and poor has repeatedly led to economic collapse, not growth.

Right now the Top 10% of Wage Earners own 80% to 90% of stocks, bonds, trust funds, and business equity, and over 75% of non-home real estate. They OWN us. The Top 10% of the World's Wage Earners have 85% of the Wealth. That means the 90% of the rest of us are scrapping and fighting over the remaining 15%. The Robber Barons of a Century Ago have returned, and this time they won't stop until they reduce the world to a Feudal State of Super Rich and Super Poor. Does it make any sense to try and plug our budget shortfalls by going after people have have nothing, or people have have Everything?

I vote that those who have Everything, can afford to Share a few slices with the Countries that MADE THEM WEALTHY in the first place. Another 3% is not going to kill them off. If were going to have class warfare, then let's fight to WIN, not scamper away just because we've been accused of not like sucking up to the Rich. In fact, if we truly want to put our financial house back in order - but want to retain the Bush Tax cuts for the Middle class as a economic stimulus - we need to go further than just restoring the 39% Clinton Top Rate from 1992, we should go to 42% for the Rich where Reagan first placed it in 1981.

These are the Frackers who took our Bailout Money and put it into their $Billion Bonuses, while trying to cut Unemployment benefits for people that whose jobs They Destroyed. Then they turned around and Bought Our Elections by laundering all that cash through the Chamber of Commerce. Sympathy is not what they deserve.

Ending tax breaks for the rich will not tank the economy, in fact, it might even give it a boost because richer people tend to seek tax shelters when their taxes go up - which means they'll start spending in order to claim more tax breaks and deductions, instead of hoarding $1.4 Trillion as they've been doing for two years now.

The Rich have the Cash, they've used the Bailouts and Tax Policy to shift it out of the pockets of working people into their vaults, bonds and stocks -- you don't go hunting for fish in the desert, you go to the WATER - so, it's high time we went to the Rich and got OUR money back.

H/T For where I really got the Title to the Diary - Aerosmith with the Best Song they've done since the 70's!

I just don't see no humor about you're way of life.

Think I can do more for you with this hear fork and knife.

...

They're dancing in the yatch club with Muff and Uncle Biff

There's one good thing that happens when you toss your pearls to swine.

That attitude might taste like shit, but it's goes real good with wine.

...

Eat The Rich, there's only one thing that they're good for

Eat The Rich, take one bite now and come back for more

So take your Grey Poupon my friend and shove it up your ass!

Vyan

No comments:

Post a Comment