President Palin? President Romney? President Huckabee?

Shiver!

I'm not crazy about extending the Bush Tax Cut Bonus for the Paris Hilton crowd. Not one bit. I see it as a deficit buster, than the Right will use a bludgeon to force through harsh cuts on the middle class and working people just when they need them most.

But let's keep in mind one thing.

About 2 Million Americans have just avoided joining the ranks of the Cat Food Nation, and that's a good thing.

Without this relief, could we have seen a double-dip recession? I wonder.

Let's realize the times we live in, people are Desperate. Obama didn't simply "cave" - he got something, several things, in this deal that are desperately needed. From my perspective he put the American People First, maybe even ahead of his own prospects for reelection with an hyper-energized Right and a Demoralized and Pissed-Off Left.

I've already read this morning that some economists argue that the extension of Unemployment and the stim-styled payroll tax holiday won't create that many jobs. It'll only create about 700,000 they say.

I guess we'll have to see, but what about this...

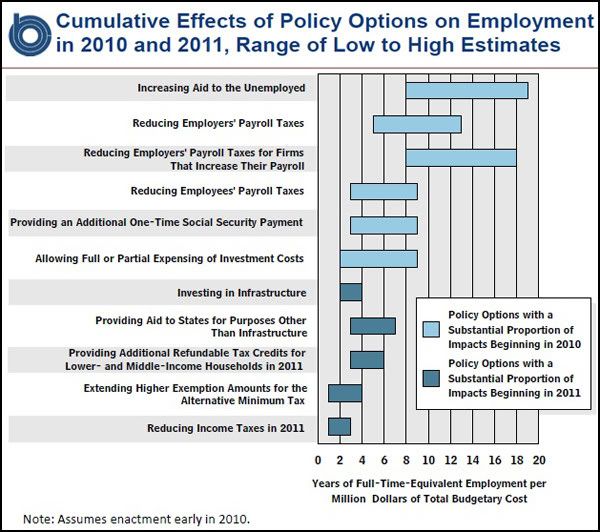

We may agree that Paris Hilton cuts won't do much to push the economy forward since that forth bottle of Cristhal and Bedazeled Lexus Logos aren't really an emerging world-wide market. But look, the top four most stimulative items as rated by the CBO, starting first and foremost with a 13 month extension of Unemployment, as well as several forms of PAYROLL TAX HOLIDAY to the tunes of over $260 Billion are what we got in this deal in exchange for $90 Billion (over two years) of leaving the tax rates exactly where they already are.

It's not the deal I would have liked (Filibuster Moratorium Anyone?), but it's really, seriously, not that bad.

Nobody wanted to raise taxes on the middle class (except Republicans, who only care about that as a talking point, not actual policy).

Historically speaking Obama is taking a big gamble here, one that doesn't shy that far away from what occurred with Ronald Reagan at about this same point. Despite being known as the "Great Tax Cutter", by this point in his Presidency Reagan was actually Raising Taxes including SSI and Payroll taxes. At the time it was called the Greatest Tax Hike in History.

Reagan came into office proposing to cut personal income and business taxes. The Economic Recovery Act was supposed to reduce revenues by $749 billion over five years. But this was quickly reversed with the Tax Equity and Fiscal Responsibility Act of 1982. TEFRA—the largest tax increase in American history—was designed to raise $214.1 billion over five years, and took back many of the business tax savings enacted the year before. It also imposed withholding on interest and dividends, a provision later repealed over the president's objection.

But this was just the beginning. In 1982 Reagan supported a five-cent-per-gallon gasoline tax and higher taxes on the trucking industry. Total increase: $5.5 billion a year. In 1983, on the recommendation of his Special Security Commission— chaired by the man he later made Fed chairman, Alan Green-span—Reagan called for, and received, Social Security tax increases of $165 billion over seven years. A year later came Reagan's Deficit Reduction Act to raise $50 billion.

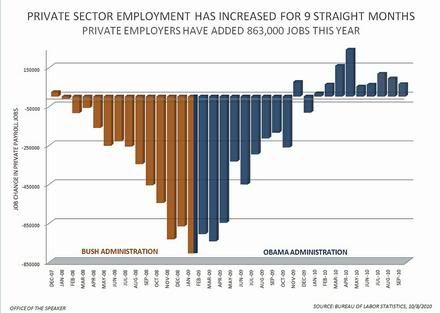

By 1984 the Economy had finally begun to recover, despite his tax increases, and Reagan won a near landslide re-election. THIS is what Obama is gambling on, that by rolling the bones and Saving the Nation's Economy he will be ultimately rewarded for his sacrifice. This is what he's done so far, 9 Straight Months of private sector job growth and continuing...

And if the the gamble pays off, he bloody well SHOULD BE rewarded.

Just 750,000 jobs is about 80% of the growth we've seen this year, and if the economy truly begins to recover we could easily see twice that - or more.

We're talking about people's livelihood's here. About their ability to eat, survive, maintain shelter and safe environs. This deal has real life consequences that will be felt almost immediately and reverberate for months, if not years.

We're inches away from having DADT repealed, a policy that was previously implemented by Democratic President Bill Clinton, who also signed into law the ridiculously titled "Defense of Marriage Act". Clinton had many failures and disappointments too. He permanently modified welfare and turned it into a temporary (and far more cruel) system. When he came into office he promised to implement a BTU tax to help curb OIL and Carbon consumption, as well as a middle-class tax cut.

He never accomplished any of those goals, yet he was still re-elected for a second term and is thought as probably our best Democratic President since Kennedy.

No, Obama is far from perfect but if you still have heart-burn over the lost Public Option, here's some Pepto - as I've stated repeatedly it wasn't just removed with was Replaced with another Option that Scored just as cost effective as the P.O. according to the CBO. The P.O. was never the be-all-end-all, there are other ways to accomplish the exact same thing, and that may - ultimately - be true in this case.

Yes, it does kick the can down the road, and in the next round I think we shouldn't just go back to Clinton Rate but actually raise the Top Marginal Tax Rate to 42% in order to pay for extending Middle-Class Cuts - but the Senate this time around was completely cock-blocked. In a year or two we'll be dealing with a different economic situation, and with luck a different filibuster scenario in the Senate.

Yesterday was frustrating, but it's just a battle - it's not the last fight in the war.

Vyan

No comments:

Post a Comment